The VAT rules that Italy follows are contained within the VAT Law, while tax authorities issue administrative doctrines that include statements on the VAT compliance rules. The Ministry of Finance oversees the entire VAT System. The current VAT rate applied in Italy is 22%, however, lower rates apply. One of our company formation agents in Italy can offer information and guidance for VAT registration in 2023.

| Quick Facts | |

|---|---|

| We offer VAT registration services |

He help you with: – preparation of documents, – submission to the relevant tax authorities for resident and non-resident companies in Italy |

|

Standard rate |

22% |

|

Lower rates |

– 10% for specific food products, agricultural supplies, sports and cultural events, hotel accommodation; – 5% for social services, certain means of transportation; – 4% for medical equipment, newspapers and periodicals |

| Who needs VAT registration |

Companies with a turnover of minimum EUR 500,000 per year for the supply of services and EUR 800,000 for the supply of goods |

| Time frame for registration |

Around 3 weeks |

| VAT for real estate transactions |

Standard rate of 10% for most properties, and 22% for luxurious real estate |

| Exemptions available |

No VAT for export of products, intra-community supplies, transactions with Vatican City and San Marino |

| Period for filing |

On a quarterly basis |

| VAT returns support |

Yes, monthly or quarterly, depending on the company turnover |

| VAT refund | For resident and non-resident entities that carry out taxable transactions; a flat VAT rate applies to specific supplies |

| Local tax agent required |

Yes |

| Who collects the VAT |

Ministry of Economy and Finance |

| Documents for VAT registration |

– Certificate of Incorporation, – declaration with the activities of the company, – ANR/3 form offered by Agenzia delle Entrate |

| VAT number format |

IT country code followed by 11 digits |

| VAT de-registration situations | When the company closes the activities in Italy or relocates to another country |

Table of Contents

What types of companies should register for VAT in Italy?

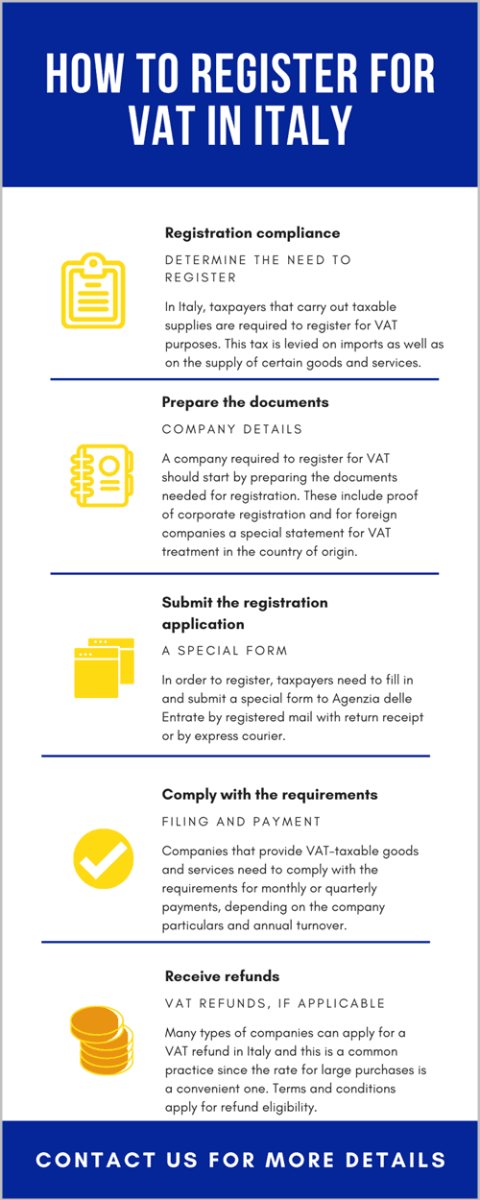

VAT registration in Italy is mandatory in some cases. Understanding the current conditions not only for registration but also for declaring and paying this tax is important for resident as well as non-resident companies. Our team of agents who specialize in company formation in Italy is able to provide complete assistance, as needed. We can answer any additional questions, apart from the ones discussed herein.

The criterion for registration is whether or not the company carries out taxable supplies in the country. Many types of business activities or services are considered for this purpose, such as financial services, medical services, export sales as well as selling different types of goods, from foodstuffs to books and periodicals.

Non-resident companies that provide goods or services may be required to register with the Italian tax authorities as taxpayers. This is usually required if a company buys and sells goods within Italy and the supplier and customers are not Italian companies with VAT registration if a company deals with the provision or acceptance of intra-community suppliers, receipt of goods as acquisition from other EU States. On the list, there are also sales to individual customers using the internet, as they are subject to the Italian distance selling restoration threshold.

Non-resident taxable individuals who will derive income from the country are also required to comply with certain requirements and should follow these steps for VAT registration in Italy:

- submit the ANR/3 form to Agenzia delle Entrate (this can be done personally, by express courier or by registered mail with return receipt – it cannot be submitted electronically);

- enclose the documents, such as a copy of the applicant’s identification details, and a recent statement from the country or origin’s Chamber of Commerce stating that the applicant is treated as a taxable person for VAT purposes in his country.

- a self-statement on the activities the applicant undertakes/will plan to undertake in Italy.

An individual who registers in such a manner for VAT purposes in Italy will receive the credentials that will allow him to submit the VAT return and make the necessary payments online. This example of VAT registration in Italy can apply to individuals who are entrepreneurs, artists or self-employed. One of our agents who specialize in company incorporation can provide more details for those who are interested in coming to the country and deriving income from their activities.

When it comes to European Union, if your company is in Italy and you want to run your business outside Italy, you need to ask for the “VAT identification” in a few EU countries.

One should note that the input VAT on purchases of goods and services related to business operations is normally allowed for recovery. However, special limitations can apply in relation to specific items like entertainment expenses or cars and to companies carrying out both taxable transactions and transactions exempt from VAT without the right to deduct such tax.

Starting from January 2024, the following thresholds entered into force, for taxable persons who opt for VAT settlement:

• EUR 500,000 for the provision of services only;

• EUR 800,000 for the supply of goods.

Non-residents in Italy wanting to open a company in this country should fulfill the VAT obligations in Italy if they also carry out activities for non-commercial entities that are not VAT-registered. As such, non-residents will still be able to claim refunds or deduct VAT on purchases.

There are also other countries, where there is no threshold for registering for VAT, such as Spain, where VAT registration is mandatory for all companies that carry out transactions in this country.

VAT registration in Italy for foreign companies

Foreign companies that wish to start a business in Italy are required to register for VAT (Value Added Tax) if they respect certain conditions:

- Importing goods to Italy or buying and selling goods in Italy

- Having a branch or a liaison office in Italy

- Carrying out intra-Community acquisitions of goods in Italy.

If you satisfy the conditions, you have 30 days to register for VAT after setting up your business in Italy. Registration for a VAT number in Italy can be made by applying online on the website of the legal authority in charge of this procedure. For guidance on registering, one of our experienced lawyers in Italy can advise you on every step of the process.

The regulations and the steps may vary according to the nature of the business opened in Italy. This being said it is recommended to seek professional advice from an experienced local company incorporation firm before setting up your company and applying for VAT registration in Italy.

The steps for VAT registration in Italy for foreign companies are the following:

- Analyze the requirements and find out if you are eligible for VAT registration in Italy. If you have doubts do not hesitate to ask for legal guidance from our firm specialized in opening a business in Italy

- Obtain an Italian Identification Number (Codice Fiscale)

- Collect the necessary documentation, including your company’s registration documents, a certificate of incorporation, and proof of an Italian address.

- Submit the application for VAT online with the Italian Tax Authorities.

- Wait for confirmation of your VAT registration

- Receive the confirmation and a VAT identification number

- Once registered, you will be assigned an Italian VAT number and will be required to charge VAT on all taxable supplies made in Italy, file VAT returns and pay any VAT due to the Italian tax authorities.

Please note that it is necessary to complete a new activity commencement form and register it to the Italian Revenue Agency office within 30 days if any of the details delivered in the declaration of company operations have changed. This is important from a VAT point of view.

You have to keep track of all the transactions you make using your VAT number and respect the regulations in place. If you need help with the financial/organizational side of the business we encourage you to seek professional advice from an accountant in Italy.

Here is a video presentation with information about VAT registration in Italy:

VAT registration in Italy for local companies VERSUS foreign companies

The process for VAT registration in Italy for local and foreign companies is the same, with a few exceptions:

- Local companies are required to register for VAT in Italy if their annual income exceeds €22,000, while foreign companies do not necessarily have to meet this financial expectation. It is enough if external companies buy and sell goods on the Italian territory, have branches there, and meet all the other general conditions.

- VAT rate: It varies by the country of origin of the company applying for a VAT number. If you are interested in the exact rates, do not hesitate to contact one of our specialists in company formation from Italy.

- Intrastat: Local companies are required to submit Intrastat declarations for all the products bought or sold on the territory of the European Union. This regulation does not apply to foreign companies in the same manner.

- VAT number format: Just by looking at the format of the VAT number you can tell if the company is local or foreign.

An important aspect to mention is the fact that the laws governing company formation in Italy or related to obtaining a VAT number are often subject to change. In case you need help keeping track of all the VAT transactions, recipes, and invoices ask for guidance from an accountant in Italy. As for the legislation related to setting up a company in this country, it is recommended that you consult a specialist in company formation in Italy before committing to a decision.

How is VAT declared and paid in Italy?

Companies that have received a VAT number in Italy are expected to comply with the requirements for declaring and paying this tax. Monthly payments are common, however, companies may also opt to make the necessary payment every quarter. For this to be possible, the said company needs to have a turnover of no more than 700,000 EUR (in those cases in which the activity of the company includes more than the supply of services) or below 400,000 EUR when the activity of the company is composed only of the supply of services. Investors should know that when they select the quarterly payment they will be subject to interest (1% of the due VAT per each quarter).

Retailers are required to store the data on the business-to-customer transactions using electronic means (including for transactions that are not documented via an electronic invoice, such as the sale of items in a shop).

Our team can provide investors with detailed information on how to fill in the forms (for example the F24 form) as well as other needed statements. The VAT formalities for 2024 in Italy can be explained by our specialists.

Opening a business in Italy can be done in about 7 days, respecting the formalities involved and contacting our local agents. Among them, drafting the required documents, opening a local bank account, and registering for the payment of taxes such as VAT and corporate tax are the most important. We mention that an SRL can be established with a minimum share capital of 1 euro and by 1 shareholder. Contact us to find out details about our services.

Payroll in Italy involves, broadly speaking, the delivery of salaries to the accounts of a company’s employees, as well as the drafting of tax declarations, according to the law. With the help of standard procedures and formalities, the respective salaries are calculated, and then the related taxes must be paid. Only after the managers have signed salary slips, they are distributed in the company. But all aspects can be explained in detail by our specialists, so don’t hesitate to contact us.

What are the VAT rates in Italy in 2024?

The value-added tax rates in Italy are the following:

- 22%: this is the standard VAT rate applicable to many of the common types of goods and services offered by companies.

- 4%: applicable to some foodstuffs, medical equipment, books, newspapers, periodicals, etc.

- 5%: applicable to the transport of passengers (in some cases) and to certain types of foodstuffs for which the 4% rate does not apply.

- 10%: applicable in case of water supplies, pharmaceutical products, and admission to cultural services (cinema, theatre, shows).

- exempted: VAT exemptions apply to medical services, gaming and gambling, export sales, the contribution of assets to a company and others.

As seen from above, the reduced rates can apply to more than one category, in some cases, when this is the case (for example, in case of foodstuffs), entrepreneurs should obtain more information on the particular sub-categories to which a certain value will apply. One of our agents who specializes in VAT registration in Italy can provide you with more details on the current rates and the categories to which they apply.

Italy implemented the One Stop Shop and the Import One Stop Shop which are voluntary VAT structures. Such schemes allow taxable persons to release the VAT requirements for specific transactions.

How can VAT refunds be obtained in Italy?

Foreigners who visit Italy may receive a refund of the VAT tax paid on goods bought for deportation. In order to proceed with the refund, the visitor must present his passport, the receipts of the goods and proof of the deportation of the goods to an Italian VAT refund station, usually found in airports, tourist offices, or international travel hubs. Companies that are an EU business but do not usually supply goods or services to Italy (and have thus never been subject to VAT registration in Italy) cannot deduct the VAT.

However, the VAT tax refunds are different by region; therefore, visitors should always check the terms and conditions of the Italian VAT refund.

If you need more information on the VAT applied in Italy in 2024, our company formation agents in Italy can help you with any specific information. Contact us for assistance.